A paystub maker, also known as a paycheck stub generator, is an online tool designed to create digital or printable pay stubs. With minimal effort, you can generate a legally valid document showing employee earnings, deductions, and net pay. Let’s dive deeper into how paystub makers work, their benefits, and why you should consider using one.

What Is a Paystub Maker?

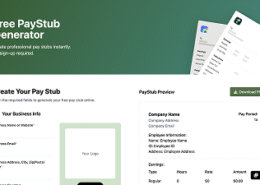

A paystub maker is an online software application that allows users to create customized pay stubs. Users simply input relevant employee information, hours worked, rate of pay, tax deductions, and other withholdings. The system then calculates totals and provides a professionally formatted pay stub that can be downloaded or printed instantly.

Whether you’re a sole proprietor paying yourself or a business managing multiple employees, a paystub maker is an efficient alternative to expensive payroll services or manual calculations.

Why Use a Paystub Maker?

1. Time-Saving

Creating pay stubs manually or hiring a payroll service can be time-consuming. With an online paystub generator, you can create a professional pay stub in just minutes.

2. Cost-Effective

Most paystub makers are either free or offer budget-friendly pricing options, especially compared to hiring accountants or subscribing to full-service payroll software.

3. Professional Appearance

High-quality paystub templates give your business a polished, legitimate look. You can often add your company logo and customize layout details to suit your branding.

4. Accuracy

Automatic calculations reduce the risk of human error. These tools usually include built-in tax tables to ensure correct deductions for federal, state, and local taxes.

5. Accessibility

You can generate stubs from anywhere no downloads or installations needed. Just access the platform from any internet-connected device.

6. Record Keeping

Paystub makers allow you to keep accurate and detailed records of payments made. This is essential for taxes, audits, and employee disputes.

What Information Is Included on a Pay Stub?

A pay stub generated by a reliable paystub maker will include:

-

Employee Name & Address

-

Employer Details

-

Pay Period

-

Pay Date

-

Gross Earnings

-

Hours Worked

-

Overtime Pay (if any)

-

Deductions (federal tax, Social Security, Medicare, etc.)

-

Net Pay (take-home pay)

-

YTD (Year-to-Date) Totals

Having all of this on one professional document makes financial tracking and compliance much easier.

Who Can Benefit from a Paystub Maker?

🔹 Small Business Owners

Running a startup or small business often means handling multiple roles, including payroll. A paystub maker simplifies the payroll process without the need for complex software or expensive professionals.

🔹 Freelancers and Independent Contractors

Even if you’re self-employed, having a pay stub is crucial when applying for loans, renting an apartment, or proving income. A paystub maker gives you an easy way to document your earnings.

🔹 Employees Needing Income Proof

Some employers may not issue regular pay stubs, especially for part-time or cash-paid jobs. A paystub maker allows employees to create proof of income when needed.

🔹 Landlords, Loan Officers, and Financial Institutions

These parties can use paystub makers to verify tenants’ or borrowers’ income by requesting stubs generated through reputable platforms.

Features to Look for in a Good Paystub Maker

When choosing a paystub maker, ensure it offers the following:

-

Customizable Templates: Add logos, company names, and address formats.

-

Real-Time Tax Calculations: Based on your state and federal tax rules.

-

Data Security: Look for encryption and privacy protection for sensitive information.

-

Download Options: PDF or print-ready formats.

-

Mobile-Friendly Interface: Generate stubs on the go.

-

Customer Support: In case you have questions or issues.

Is It Legal to Use a Paystub Maker?

Yes as long as the information provided is accurate and truthful, using a paystub maker is completely legal. It’s a tool meant to assist in documenting payments and providing income verification. However, falsifying income on a pay stub is illegal and considered fraud. Always ensure the details entered are legitimate and reflect actual payments.

Final Thoughts

A paystub maker is an invaluable tool for businesses and individuals alike. It offers an affordable, fast, and professional way to create pay stubs that serve both legal and financial purposes. Whether you’re paying yourself, your employees, or documenting freelance income, this tool can save you time, money, and administrative headaches.