California is one of the most attractive states for professionals and executives looking for career growth, high-paying roles, and innovative industries. Cities like San Francisco, Los Angeles, San Diego, and San Jose offer excellent job opportunities across technology, healthcare, entertainment, and executive leadership. However, California is also known for its high state income taxes, which makes understanding your real earnings essential. This is why a california paycheck calculator is such an important financial tool.

A salary offer may look impressive, but once federal taxes, California state income tax, Social Security, Medicare, and benefit deductions are applied, your take-home pay can be very different. A paycheck calculator removes confusion and helps you make confident career and financial decisions.

Why You Need a California Paycheck Calculator

California’s tax structure is more complex compared to many other states. Without proper calculations, professionals often overestimate their net income. A california paycheck calculator helps you:

-

Calculate exact take-home pay after federal and state taxes

-

Understand Social Security and Medicare deductions

-

Include health insurance, retirement, and benefit costs

-

Estimate bonuses, commissions, and incentive pay

-

Compare multiple job offers realistically

For executives, accurate pay calculation is critical before accepting senior leadership or C-level roles.

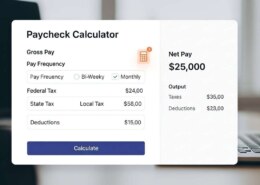

How a California Paycheck Calculator Works

A california paycheck calculator starts with your gross salary and subtracts mandatory and optional deductions, including:

-

Federal income tax

-

California state income tax

-

Social Security contributions

-

Medicare contributions

-

Health insurance premiums

-

Retirement plan contributions (401k, 403b, etc.)

-

Bonuses, commissions, and equity compensation

By entering accurate details, professionals can instantly see their net income and plan their finances more effectively.

California Salaries vs Actual Take-Home Pay

California is famous for high salaries, especially in technology and executive roles. However, higher pay does not always mean higher savings. State taxes and deductions can significantly reduce your net income.

Using a california paycheck calculator allows professionals to:

-

Compare offers across different California cities

-

Understand how taxes impact real earnings

-

Plan relocation or lifestyle adjustments

-

Evaluate executive-level compensation realistically

This clarity is especially important for executives moving from low-tax states to California.

Why Executives Should Always Calculate Their Pay

Executive compensation packages often include complex elements such as bonuses, performance incentives, stock options, and long-term benefits. A california paycheck calculator helps executives:

-

Understand post-tax income from bonuses and incentives

-

Compare total compensation packages accurately

-

Evaluate base salary versus variable pay

-

Plan savings, investments, and long-term financial goals

Many professionals working with an executive employment agency use paycheck calculators as part of their offer evaluation and negotiation strategy.

The Role of an Executive Employment Agency

An executive employment agency plays a key role in helping professionals secure leadership positions and negotiate competitive compensation packages. These agencies support candidates by:

-

Providing salary benchmarking and market insights

-

Explaining complex compensation structures

-

Assisting with offer evaluation and negotiation

-

Aligning career opportunities with long-term goals

When combined with a california paycheck calculator, an executive employment agency helps candidates understand the true value of an offer beyond just the gross salary.

Common Paycheck Estimation Mistakes in California

Many professionals make avoidable mistakes when estimating take-home pay, such as:

-

Ignoring California state income tax

-

Overlooking benefit and insurance deductions

-

Miscalculating bonus or equity taxation

-

Assuming a high salary equals high net income

A california paycheck calculator eliminates these errors and provides accurate, transparent calculations.

How Paycheck Calculators Support Career Planning

Career planning is not only about job titles—it’s also about financial stability. A california paycheck calculator helps professionals:

-

Plan monthly budgets and savings goals

-

Compare multiple job offers confidently

-

Evaluate executive and leadership roles

-

Understand affordability in high-cost cities

Executives working with an executive employment agency often rely on paycheck calculators to ensure their career moves are financially sustainable.

Financial Transparency in California’s Job Market

California’s job market is highly competitive. Financial transparency helps professionals make smarter decisions and reduces long-term dissatisfaction. A california paycheck calculator provides a realistic view of earnings, helping candidates understand exactly what they will take home.

This transparency benefits both employers and employees, especially at the executive level where compensation structures are more complex.

Why Accurate Pay Calculation Matters for Executives

Executives often make decisions that affect their family, lifestyle, and long-term financial security. Misjudging take-home pay can create unnecessary stress—even with a high salary.

By using a california paycheck calculator along with guidance from an executive employment agency, executives gain confidence, clarity, and control over their financial future.

Final Thoughts

California offers exceptional career opportunities, but its higher taxes make accurate pay calculation essential. A california paycheck calculator helps professionals and executives determine real take-home pay, avoid surprises, and make informed financial decisions.

When paired with expert support from an executive employment agency, paycheck calculators empower professionals to evaluate offers strategically, negotiate confidently, and build long-term financial success. Before accepting your next role in California, calculate your paycheck—because understanding your real income is the foundation of a successful career.